All Categories

Featured

Table of Contents

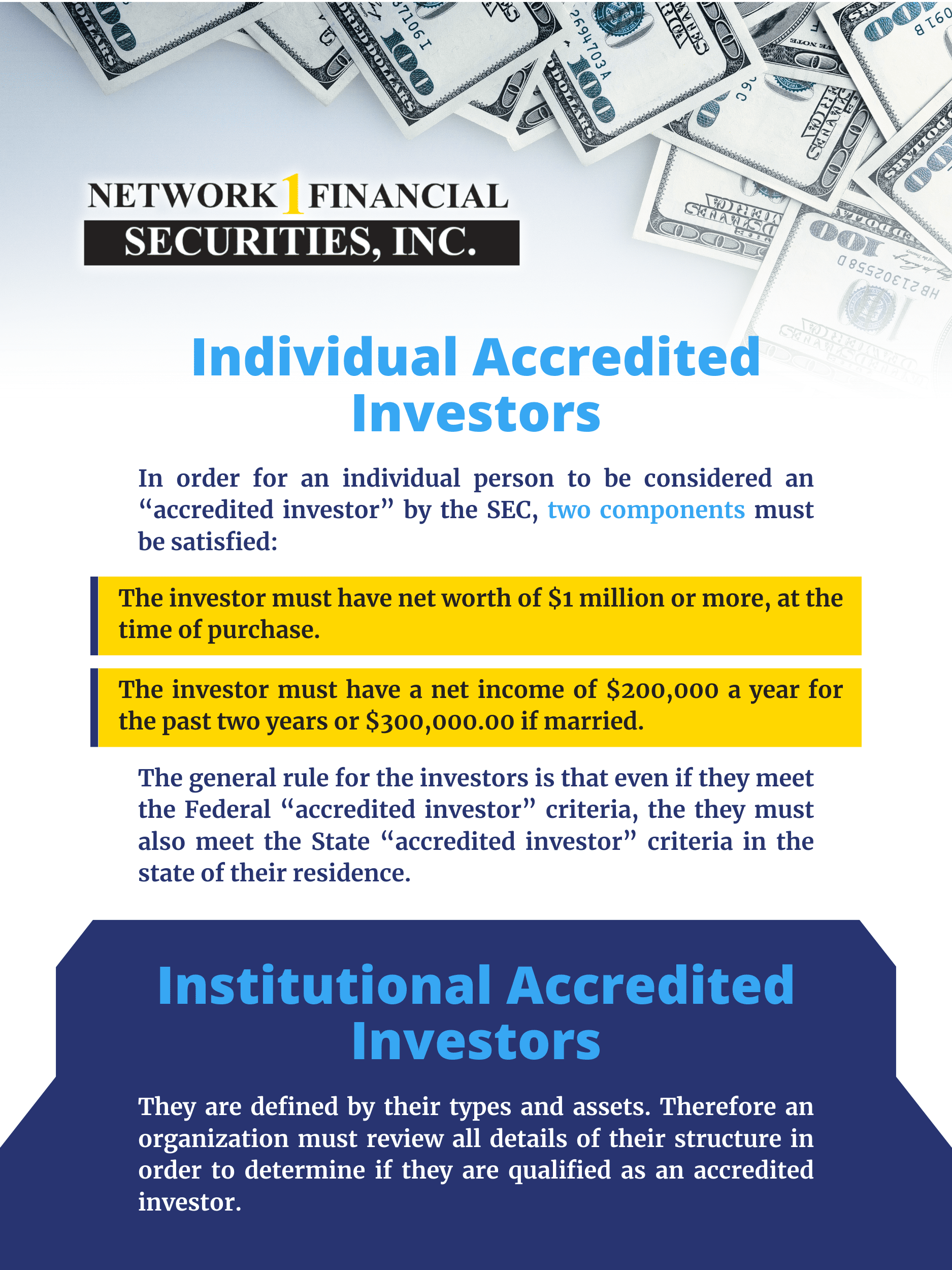

An individual must have a net well worth over $1 million, leaving out the main home (independently or with partner or companion), to qualify as an approved financier. Showing adequate education and learning or job experience, being a signed up broker or financial investment consultant, or having particular expert qualifications can likewise certify a specific as an accredited investor.

Certified investors have access to financial investments not signed up with the SEC and can include a "spousal equivalent" when figuring out credentials. Approved financiers may encounter prospective losses from riskier investments and should prove financial sophistication to join unregulated investments (accredited real estate investor leads). Recognized capitalist status issues due to the fact that it figures out qualification for investment possibilities not readily available to the public, such as private placements, equity capital, hedge funds, and angel investments

Non Accredited Investing

To get involved, certified investors must approach the provider of non listed protections, that might need them to finish a set of questions and supply monetary documents, such as income tax return, W-2 kinds, and account statements, to validate their status. Laws for recognized capitalists are managed by the U.S. Stocks and Exchange Payment (SEC), ensuring that they meet certain financial and professional criteria.

This development of the certified financier swimming pool is intended to preserve investor protection while supplying greater access to non listed financial investments for those with the required financial sophistication and danger tolerance. - accredited investor income

Accredited Investor Property

Real estate syndication is rather comparable to REITs since it additionally includes pooling resources to buy realty financial investments. A submission bargain is when numerous capitalists merge their sources together to buy a single property residential property. This bargain is assembled by a syndicator, likewise called the general enroller.

These capitalists will certainly give most of the capital required to get the building. The distinction with REITs is that you can choose what submission bargains to take part in. If you believe in the property residential or commercial property being syndicated, you can join as one of the passive investors. Realty submission can be done with any type of kind of property, but multifamily submission is one of the most popular kind because multifamily residential or commercial properties often generate a whole lot of consistent income.

Additionally, these large residential properties are usually more challenging to get as a single capitalist, which is why submission is an optimal arrangement. Investors can take part in multifamily actual estate spending with a much lower minimum financial investment.

Accredited investors do not have to accumulate rental earnings, bargain with tenants, manage emergency situations, invest money on repair services, etc. Either the syndicator will certainly hire a third celebration residential property supervisor to do this or they will certainly manage it themselves.

This suggests financiers obtain easy earnings from leas, and the eventual structure sales. This is based on what percent of the building they have, depending on the offer framework.

Foreign Accredited Investor

Our viewpoints are our own. An approved investor is an individual or organization that can spend in uncontrolled protections.

Non listed safety and securities are naturally dangerous but usually offer greater rates of return. If you've ever stumbled upon an investment offered only to so-called certified capitalists, you have actually likely wondered what the term suggested. The label can put on entities ranging from substantial banking organizations and well-off Fortune 500 companies, right down to high-earning households and even individuals.

, giving market access to smaller business that might otherwise be crushed under the costs accompanying SEC registration.

Financiers without certification can manage the complete breadth of authorized securities like stocks, bonds, and common funds. They can also gather wealth, purchase real estate, develop retired life profiles, take risks, and gain benefits the most significant difference is in the range of these undertakings. One of the benefits of being a recognized capitalist is that once you acquire this condition, it "unlocks" accessibility to products not offered to the public, such as hedge funds, financial backing funds, private equity funds, and angel investing.

For instance, the SEC takes into consideration hedge funds an extra "versatile" financial investment technique than something like mutual funds, since hedge funds make use of speculative techniques like leverage and brief selling. Given that these facility items require extra research study and understanding, capitalists require to show that they comprehend the risks associated with these kinds of financial investments prior to the SEC fits with them diving in

While many are primarily familiar with the SEC's consumer defense initiatives, the regulatory authority's obligations are actually twofold. Along with guarding investors, it's likewise in charge of capital formation essentially, helping the market gather funding. To make certain that those two efforts aren't in conflict, it's often essential for the SEC to match up risky, high-reward possibilities with ideal financiers.

Accredited Investor Markets

One assists navigate the uncontrolled market, and the other will drift you to safety must the waves intimidate. At the same time, the average investor is secure on the beach or paddling in the shallows, risk-free under the careful gaze of the lifeguard (i.e., the SEC). Securities that are readily available to recognized capitalists are provided via private offerings, which might feature less regulations than safeties used to even more routine capitalists.

By Percent - January 11, 2021 When it comes to buying stocks and bonds, practically any individual can invest. As long as you more than the age of 18 (or 21, in some states), not trading on within details, or not spending as component of a conflict of rate of interest, you can be a part of public markets whether you have $1 or $1 million.

Particular financial investment vehicles including those on Percent are only offered to a course of capitalists legally specified as These investors have the explicit consent from regulative bodies based on a narrow collection of standards to purchase certain types of investments in exclusive markets. That can be an accredited investor? Even better, why are recognized financiers a point to begin with? After the Great Clinical Depression, the united state

This act needed investors to have a far better understanding of what they were buying, while forbiding misstatements, fraud, and deception in protection sales. Congress presumed this legislation would certainly safeguard the "normal" financier. Exclusive offerings those beyond the general public stock market were exempt from safeties legislations, which developed some problems.

The Stocks and Exchange Payment (SEC) at some point took on regulation 501 of Guideline D, which formalized that might invest in exclusive offerings and defined the term "recognized investor" a term that was later on updated in 2020. A certified investor is anybody who fulfills any of the adhering to standards: Financiers with earned revenue that exceeded $200,000 (or $300,000 together with a partner) in each of the previous 2 years, and anticipates to meet the very same benchmarks in the current year.

If you are married to a recognized investor and share financial sources, you are currently additionally a recognized financier.) Those who are "well-informed employees" of a private fund. Minimal Liability Companies (LLCs) and Family members Office entities with $5 Million properties under administration. SEC- and state-registered investment advisors (however not reporting advisors) of these entities can additionally currently be taken into consideration recognized financiers.

Accredited Investor Offering

If you have a web well worth of over $1 million (not including your key property/residence), made $200,000+ a year for the last two years, or have your Collection 7 license, you can make financial investments as an approved financial investments. There are numerous various other certifications (as you can find over), and the SEC intend on adding a lot more in the future.

Since the early 1930s, federal government regulatory authorities have actually discovered it difficult to protect capitalists secretive offerings and protections while concurrently sustaining the development of startups and various other young business - companies that lots of believe are accountable for most of work growth in the USA - accredited company definition. Balancing this task had actually been center of the mind of the Securities and Exchange Compensation ("SEC") for years

Latest Posts

How To Purchase Delinquent Property Tax

Tax Lien Sale Homes

Delinquent Home Taxes