All Categories

Featured

Table of Contents

- – Acclaimed Accredited Investor Property Investm...

- – Efficient Accredited Investor Funding Opportun...

- – Accredited Investor Investment Funds

- – World-Class Accredited Investor Funding Oppor...

- – Most Affordable Private Placements For Accre...

- – Elite Real Estate Investments For Accredited...

- – Popular Venture Capital For Accredited Inves...

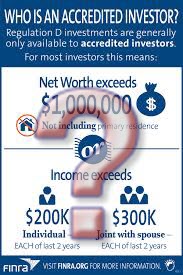

The guidelines for certified financiers vary amongst jurisdictions. In the U.S, the meaning of a recognized financier is placed forth by the SEC in Policy 501 of Law D. To be an accredited capitalist, a person must have a yearly revenue going beyond $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of earning the exact same or a higher earnings in the current year.

A certified capitalist needs to have a total assets exceeding $1 million, either individually or collectively with a partner. This quantity can not include a main residence. The SEC also considers applicants to be certified capitalists if they are basic partners, executive police officers, or supervisors of a firm that is issuing unregistered safeties.

Acclaimed Accredited Investor Property Investment Deals

If an entity consists of equity owners that are approved capitalists, the entity itself is a certified financier. However, an organization can not be formed with the single objective of buying details safety and securities - accredited investor passive income programs. A person can qualify as an accredited financier by demonstrating enough education or task experience in the monetary industry

Individuals who desire to be certified financiers do not relate to the SEC for the classification. Instead, it is the obligation of the company providing a personal placement to ensure that every one of those come close to are certified capitalists. People or events who intend to be accredited financiers can come close to the provider of the non listed safety and securities.

Suppose there is a private whose income was $150,000 for the last three years. They reported a main house worth of $1 million (with a mortgage of $200,000), a cars and truck worth $100,000 (with an exceptional finance of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Internet well worth is determined as possessions minus obligations. He or she's total assets is precisely $1 million. This involves an estimation of their possessions (aside from their key house) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan equating to $50,000. Given that they meet the total assets need, they certify to be an accredited financier.

Efficient Accredited Investor Funding Opportunities

There are a few less usual qualifications, such as managing a trust with greater than $5 million in assets. Under government safeties legislations, only those that are certified investors may take part in specific protections offerings. These may consist of shares in exclusive placements, structured products, and private equity or bush funds, to name a few.

The regulatory authorities wish to be certain that participants in these highly dangerous and complicated financial investments can take care of themselves and evaluate the threats in the absence of federal government protection. The recognized financier rules are created to secure potential investors with limited monetary understanding from adventures and losses they may be unwell equipped to hold up against.

Certified investors meet certifications and professional standards to accessibility exclusive investment possibilities. Approved capitalists should fulfill earnings and internet worth demands, unlike non-accredited individuals, and can spend without restrictions.

Accredited Investor Investment Funds

Some crucial changes made in 2020 by the SEC consist of:. Consisting of the Series 7 Collection 65, and Collection 82 licenses or various other credentials that reveal monetary know-how. This change recognizes that these entity types are frequently made use of for making investments. This adjustment acknowledges the experience that these staff members develop.

These changes increase the certified financier swimming pool by around 64 million Americans. This wider access supplies extra opportunities for financiers, but additionally boosts prospective threats as less financially sophisticated, financiers can take part.

One major advantage is the possibility to purchase positionings and hedge funds. These investment options are exclusive to certified capitalists and establishments that qualify as an approved, per SEC laws. Private placements allow business to secure funds without navigating the IPO procedure and regulatory documentation required for offerings. This gives accredited capitalists the chance to spend in arising business at a stage prior to they think about going public.

World-Class Accredited Investor Funding Opportunities for Accredited Investor Opportunities

They are deemed investments and come just, to qualified clients. Along with well-known firms, qualified capitalists can choose to buy startups and promising endeavors. This offers them tax returns and the chance to enter at an earlier phase and possibly reap rewards if the firm flourishes.

For investors open to the dangers involved, backing startups can lead to gains (accredited investor property investment deals). Several of today's tech firms such as Facebook, Uber and Airbnb came from as early-stage startups sustained by recognized angel investors. Innovative capitalists have the opportunity to check out financial investment alternatives that may produce much more profits than what public markets offer

Most Affordable Private Placements For Accredited Investors

Returns are not ensured, diversification and profile improvement choices are expanded for investors. By diversifying their profiles with these broadened financial investment methods approved capitalists can boost their techniques and potentially achieve exceptional lasting returns with appropriate risk management. Seasoned capitalists often encounter financial investment alternatives that might not be quickly available to the basic financier.

Investment alternatives and safeties provided to approved capitalists usually involve higher threats. Personal equity, endeavor funding and hedge funds commonly focus on investing in possessions that bring danger yet can be sold off quickly for the possibility of higher returns on those risky financial investments. Researching prior to spending is essential these in scenarios.

Lock up durations stop investors from taking out funds for even more months and years on end. Financiers may struggle to accurately value private properties.

Elite Real Estate Investments For Accredited Investors

This adjustment might extend recognized financier standing to a variety of individuals. Upgrading the income and asset benchmarks for rising cost of living to guarantee they mirror modifications as time advances. The current limits have stayed fixed since 1982. Permitting partners in dedicated partnerships to integrate their sources for common eligibility as accredited financiers.

Making it possible for individuals with certain professional qualifications, such as Series 7 or CFA, to certify as certified investors. Creating added requirements such as proof of financial literacy or successfully completing a certified capitalist test.

On the other hand, it might also result in knowledgeable capitalists thinking too much dangers that may not be suitable for them. Existing certified investors might face boosted competitors for the finest investment possibilities if the pool grows.

Popular Venture Capital For Accredited Investors

Those who are presently thought about recognized financiers have to stay updated on any kind of alterations to the criteria and policies. Organizations looking for certified financiers need to remain watchful regarding these updates to ensure they are bring in the appropriate target market of capitalists.

Table of Contents

- – Acclaimed Accredited Investor Property Investm...

- – Efficient Accredited Investor Funding Opportun...

- – Accredited Investor Investment Funds

- – World-Class Accredited Investor Funding Oppor...

- – Most Affordable Private Placements For Accre...

- – Elite Real Estate Investments For Accredited...

- – Popular Venture Capital For Accredited Inves...

Latest Posts

How To Purchase Delinquent Property Tax

Tax Lien Sale Homes

Delinquent Home Taxes

More

Latest Posts

How To Purchase Delinquent Property Tax

Tax Lien Sale Homes

Delinquent Home Taxes