All Categories

Featured

Table of Contents

It's essential to recognize that achieving certified investor status is not an one-time success. It's consequently essential for recognized financiers to be positive in monitoring their economic scenario and updating their documents as required.

Failing to satisfy the recurring criteria may cause the loss of accredited financier standing and the associated privileges and possibilities. While a lot of the financial investment types for Accredited Investors are the same as those for anyone else, the specifics of these investments are usually various. Personal positionings describe the sale of securities to a select group of accredited investors, generally beyond the public market.

Personal equity funds pool resources from certified capitalists to obtain ownership stakes in business, with the goal of boosting performance and creating significant returns upon departure, normally through a sale or first public offering (IPO).

Market changes, residential property monitoring obstacles, and the prospective illiquidity of property assets need to be very carefully evaluated. The Stocks and Exchange Compensation (SEC) plays a crucial duty in controling the activities of accredited financiers, who have to comply with especially described rules and reporting requirements. The SEC is accountable for imposing securities regulations and regulations to shield capitalists and keep the honesty of the monetary markets.

All-In-One Accredited Investor Crowdfunding Opportunities for Accredited Investment Portfolios

Guideline D provides exemptions from the enrollment needs for particular personal positionings and offerings. Certified capitalists can take part in these exempt offerings, which are usually included a minimal number of advanced investors. To do so, they need to give precise info to issuers, complete necessary filings, and comply with the regulations that govern the offering.

Compliance with AML and KYC needs is vital to maintain standing and gain access to numerous investment chances. Failing to adhere to these laws can bring about severe fines, reputational damages, and the loss of accreditation benefits. Allow's debunk some typical misconceptions: An usual false impression is that accredited financiers have actually an ensured benefit in regards to investment returns.

Elite Accredited Investor Opportunities

Yes, recognized capitalists can shed their standing if they no much longer meet the qualification requirements. As an example, if an approved financier's earnings or total assets falls below the assigned thresholds, they might shed their certification - accredited investor syndication deals. It's important for accredited financiers to regularly examine their economic circumstance and report any kind of modifications to make sure compliance with the laws

Some financial investment chances may permit non-accredited investors to participate through certain exemptions or stipulations. It's important for non-accredited financiers to meticulously evaluate the terms and conditions of each investment opportunity to determine their eligibility. accredited investor property investment deals.

First-Class Passive Income For Accredited Investors

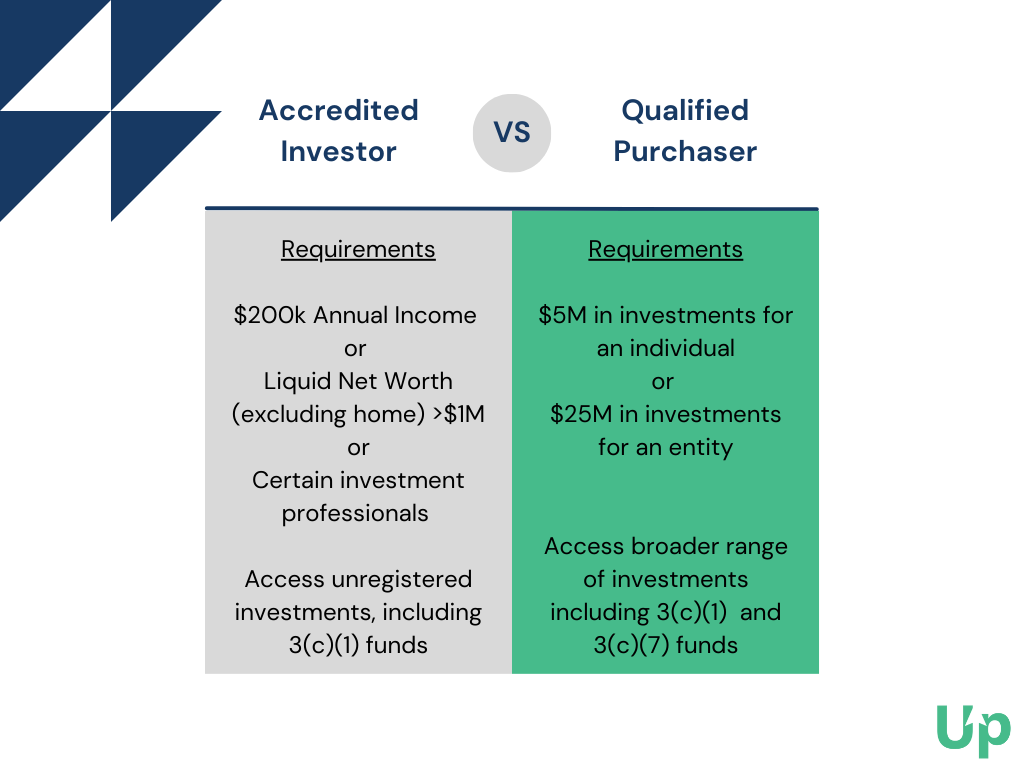

If you want to spend in particular complicated investments, the Securities and Exchange Commission (SEC) requires that you be a certified financier. To be recognized, you have to fulfill certain needs concerning your riches and revenue along with your financial investment understanding. Take an appearance at the standard demands and benefits of coming to be a recognized financier.

The SEC considers that, due to the fact that of their economic security and/or investment experience, certified capitalists have much less need for the security given by the disclosures called for of regulated financial investments. The rules for credentials, which have remained in area considering that the Stocks Act of 1933 was established as an action to the Great Clinical depression, can be discovered in Policy D, Rule 501 of that Act.

Strategic Venture Capital For Accredited Investors for Financial Growth

Nonetheless, that company can not have actually been formed just to acquire the unregistered safeties concerned. These needs of revenue, total assets, or professional experience see to it that unskilled financiers don't run the risk of cash they can not afford to lose and don't take economic threats with financial investments they don't comprehend. No real qualification is available to confirm your condition as a certified financier.

Neither the SEC nor any other regulative firm is included in the procedure. When you seek recognized investor status, you're likely to go through a screening process. You might need to complete a preliminary set of questions asking about your investment history, income, and total assets. Papers you will possibly have to generate may consist of: W-2s, income tax return, and other documents confirming profits over the past two years Monetary declarations and bank statements to validate net worth Credit history records Paperwork that you hold a FINRA Collection 7, 64 or 82 designation Documents that you are a "knowledgeable staff member" of the entity issuing the securities The ability to spend as a "knowledgeable staff member" of a fund providing safety and securities or as a financial professional holding a suitable FINRA permit is brand-new since 2020, when the SEC broadened its interpretation of and credentials for accredited financiers.

Dependable Accredited Investor Alternative Asset Investments

These securities are unregistered and unregulated, so they don't have available the regulatory defenses of authorized securities. Generally, these financial investments might be especially unstable or lug with them the possibility for substantial losses. They consist of numerous structured investments, hedge fund investments, exclusive equity financial investments, and other personal placements, every one of which are uncontrolled and might lug substantial danger.

Certainly, these financial investments are likewise attractive since in addition to included risk, they lug with them the possibility for considerable gains, normally greater than those available through average financial investments. Certified capitalists have offered to them financial investments that aren't open up to the public. These financial investments include personal equity funds, angel investments, specialty financial investments such as in hedge funds, equity crowdfunding, realty mutual fund, equity capital financial investments, and straight financial investments in oil and gas.

Companies supplying unregistered safety and securities only need to provide paperwork about the offering itself plus the area and police officers of the business supplying the protections (accredited investor passive income programs). No application procedure is called for (as is the instance with public supply, bonds, and mutual funds), and any type of due persistance or extra info supplied is up to the company

High-Value Accredited Investor Platforms

This info is not intended to be private suggestions. Potential participants need to seek advice from their personal tax professional regarding the applicability and impact of any kind of and all advantages for their very own personal tax scenario. On top of that, tax obligation legislations change every so often and there is no warranty relating to the interpretation of any type of tax legislations.

Recognized financiers (often called professional financiers) have access to investments that aren't offered to the basic public. These financial investments can be hedge funds, tough cash fundings, convertible investments, or any various other safety that isn't registered with the economic authorities. In this write-up, we're going to focus especially on realty financial investment alternatives for accredited financiers.

Latest Posts

Accredited Investor Fund

Elite Exclusive Investment Platforms For Accredited Investors

Cutting-Edge Tax Sale Overage List Program Tax Overages List